Fall, 2016

The Spinnaker is a large sail that a yachtsman deploys to take maximum advantage of prevailing winds. After a long day of sailing, it is often the sail used to bring them safely home. In a similar way, we tailor our marketing plans and investment recommendations to take advantage of current market conditions.

Right now, the market conditions in the greater Austin area are minimal interest rates, high demand for sales and leasing, rapid appreciation and a slight pause until after the holidays.

Perfect conditions for Growth Investing.

As Fall blows in, we are nearing the end of 90 degree days for the year here in Austin. School and fall sports have started. The air is filled with the sounds of marching bands and the aroma of pumpkin spice. And just like this time last year, the real estate market is taking a break. A long break – probably until January.

Not to worry, the greater Austin area is still a highly desirable place to be and is perhaps the strongest market in the US right now. But as school sets in, there are less buyers, and inventory tends to sit a little while longer on the market. Weeks and months instead of days. Which makes it the perfect time to buy, in what is normally a difficult market to buy into any other time of year.

So why should you keep reading? It’s about your long-term savings. How well are your savings growing? Is your retirement fund banking on the stock market to get you into the golden years? How well has that been working out for you? Every time the Fed threatens to raise interest rates (which is about the only way left to go), the market drops, along with your hard-earned savings. That’s no way to shore up your future.

As you may already know, Austin property taxes have been steadily rising at a rapid clip as tax valuations soar. For many homeowners, if it were not for the 10% cap that comes with our Homestead Exemption, our taxable home values would be up 12-15% in each of the past 2-3 years. What if you could put this market dynamic to work for you?

What if we could show you a smart way to take advantage of these rapidly rising home values? To grow your long-term savings by 20% a year or more with not that much more of your involvement than you have with your current retirement account? That means every $100,000 could be worth $160,000 or more in three years. It is also reasonable that you could see your investment double in that time frame. And it will be backed by the safety of Austin real estate.

We are not talking about value investing with deferred maintenance issues, remodeling, “flipping” or middle-of-the-night calls about plumbing leaks. Instead, we are talking about growth investing: good homes in good neighborhoods, professionally managed, with a proven track record of double digit appreciation.

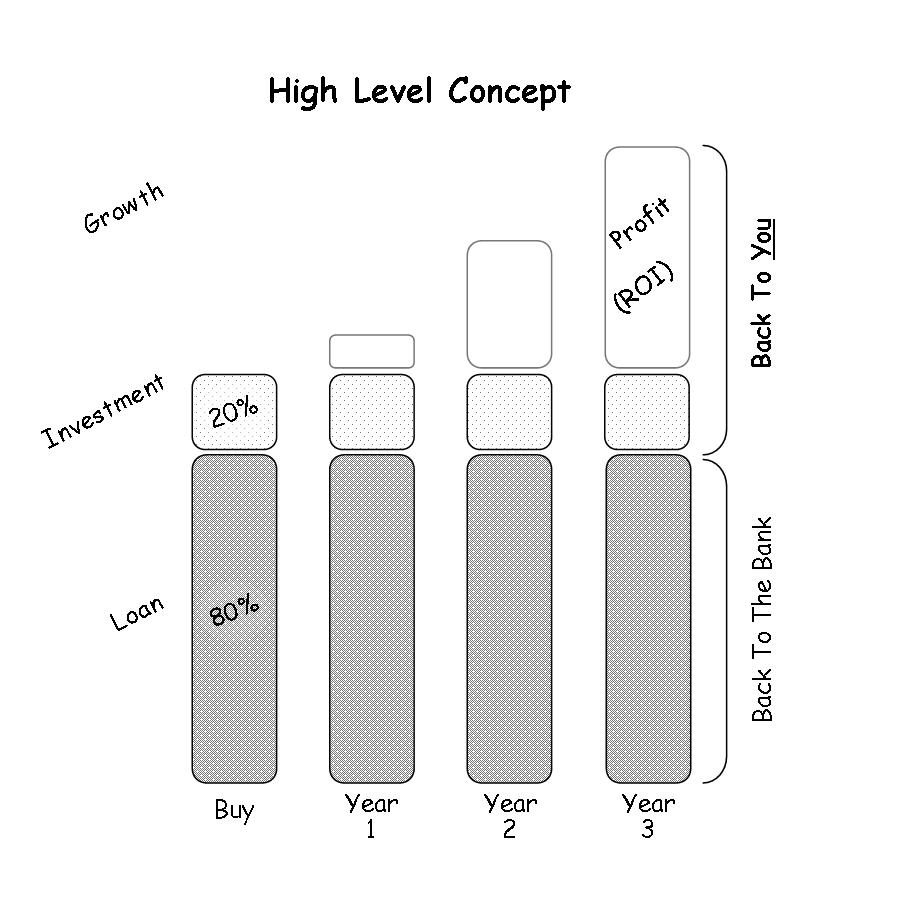

At a very high level, it works this way: you put $20,000 down on a $100,000 home. That $100,000 property appreciates 10% (compounded) each year. That means in three years, that $100,000 home is now worth $133,000.

When you sell the property, you will have a $33,000 return on your initial $20,000 investment or 165% (55% annualized) Return On Investment (ROI) – and you also get your $20,000 back. Your account now has $53,000 in it instead of $20,000. Now Compare that to the 1% (or less) ROI (called “Interest”) that your bank will give you for a 36 month Certificate of Deposit. Which would you rather have? $20,200 or $53,000?

Exactly. And it is all right here in Central Texas.

Now, there are costs of buying, selling and managing real estate, you may need to put down more than 20%; and there are no more $100,000 homes that will give us the growth we need. But, the principle really is that simple. And when all is said and done, an annualized return of 20% or more, after typical closing costs and property management fees, is a conservative planning number.

And if you need access to your money, after 10 months we should be able to liquidate your portfolio and get all of your investment back – maybe sooner. Try that with your bank’s 36-month CD.

Not every neighborhood is rising at the same rate, and not every property in these neighborhoods is going to perform either. That’s where Spinnaker Realty comes in. For twelve years we have been helping investors make their performance goals, using our success team of industry partners to finance, purchase, and manage real estate to make them money. Good money. And we have a proven quick-path process that identifies current opportunities ideal for growth investing. Ideal for growing your retirement account.

So if you have at least $60-80,000 parked in an account, and have at least 2-3 years before you need to tap it, call us today. We will help you get that money working for you again!